Guests and reservations

Distribution and operations

By Business Size

By need

By Accommodation Type

Outdoor stays

Maximize high season returns with dynamic pricing and an enhanced online presence

Guesthouses and B&Bs

Perfect the details that matter with tools that foster a warm, welcoming experience

Vacation rentals

Build a distinctive brand that drives direct bookings and fosters lasting loyalty

Serviced apartments

Provide exceptional service at scale for sustainable profitability

Urban rentals

Capture competitive markets with strategic pricing and increased visibility

Aparthotel

Manage multi-unit apartments efficiently while enhancing distribution opportunities

Guesty knowledge hub

Smart resources for smarter

business decisions

Blog

Latest tips and strategies for operational excellence

Reports & guides

Expert resources and insights to drive your business forward

Customers

Real success stories from businesses thriving with Guesty

Events

Connect and learn at our virtual and in-person gatherings

Marketplace

Third-party integrations to enhance your Guesty experience

Affiliate program

Become a Guesty partner and start earning

Help Center

Quick guides and videos to master Guesty's features and tools

Essential reading

Curated content every property

manager should see

Industry insights

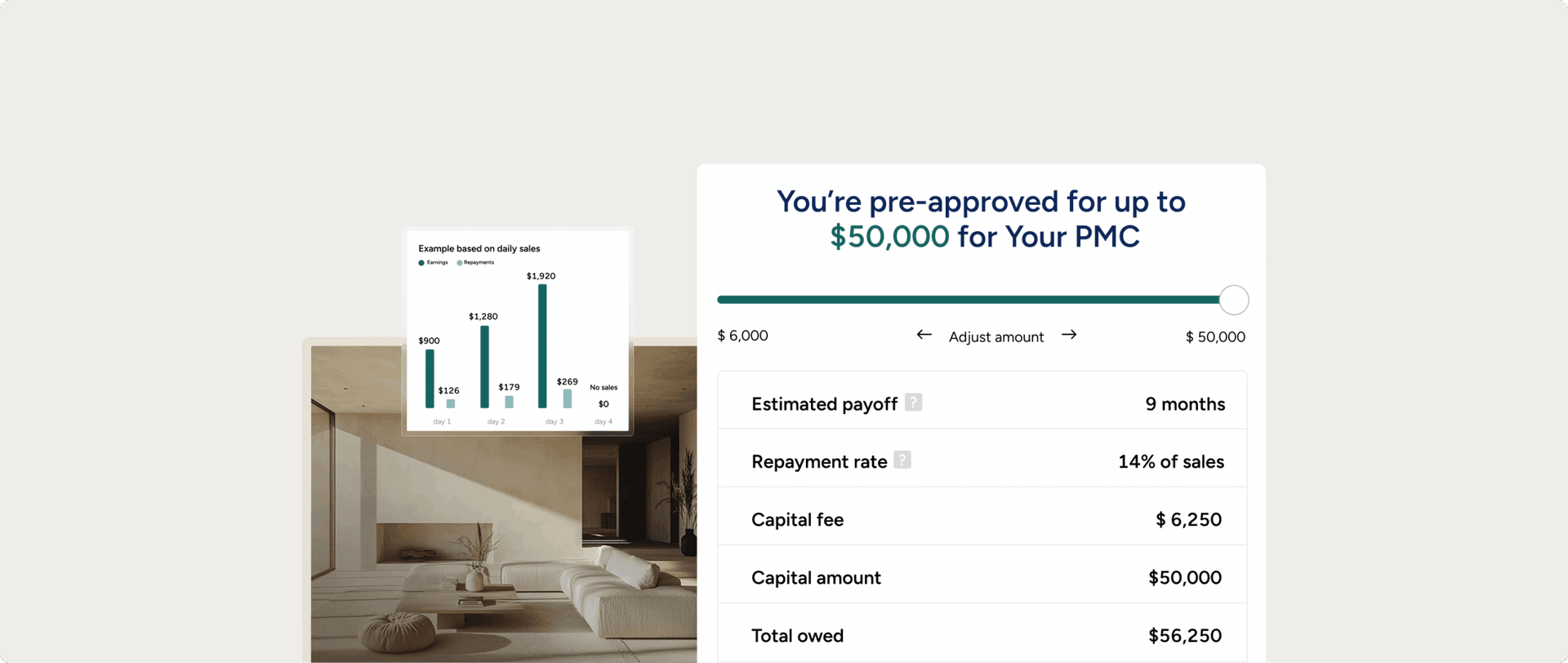

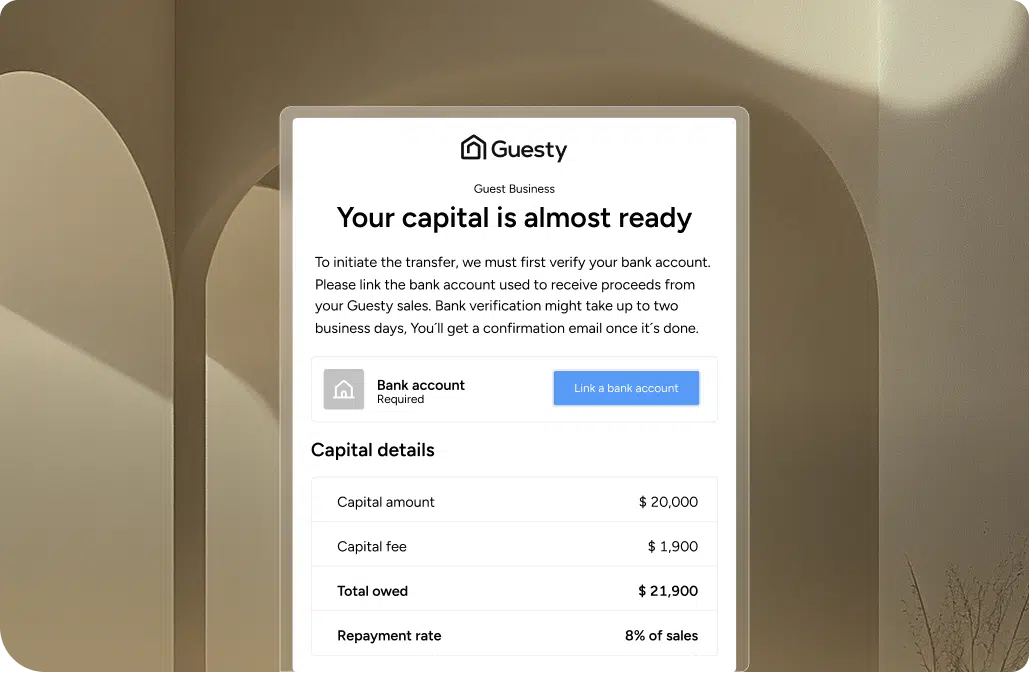

Supercharging

revenue for

short-term rentals