Welcome to the third installment of The Pulse of the Ecosystem, our monthly recap of the biggest events that took place over the last month and how they impact the current and future state of our ecosystem.

Let’s dive right in.

Big Gains for the Major OTAs

Major Online Travel Agencies (OTAs) have released their financial reports for Q4 2021, and the results are encouraging to say the least (and, in some cases, record-breaking).

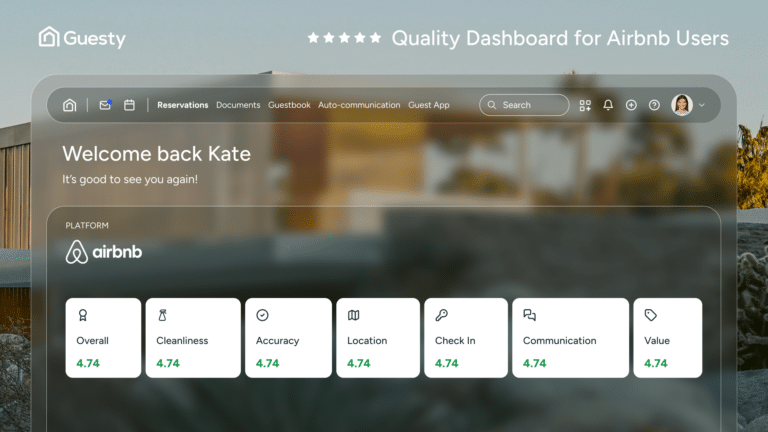

“Best Year in Airbnb’s History”

Despite the continued effects of the pandemic, Airbnb said 2021 was the “best year in Airbnb’s history”. Airbnb’s revenues for both Q4 and 2021 overall were up nearly 80% year-on-year and even surpassed 2019 levels with Q4 revenue of $1.5 billion, up 78% year-on-year, and full-year 2021 revenue notching $6 billion, up 78% over the same period last year.

Long-term stays remain the platform’s fastest-growing category by trip length and accounted for 22% of nights booked in Q4 of 2021, up 16% from the same period in 2019. The company also said that its Host community had reached six million active listings and earned a record $34 billion last year.

Record Profitability for Expedia Group

Expedia Group had an adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $479 million in Q4 of 2021, the highest in company history. It was also the third consecutive quarter of positive adjusted EBITDA.

“The fourth quarter performance further illustrates how we are running a much more efficient business vs prior to the pandemic”, said one Expedia employee. One glaring marker of this efficiency is that Expedia has ten thousand fewer employees now than it did in 2019.

Increased Revenue for Booking.com

Booking.com’s fourth-quarter revenue more than doubled to $2.98 billion from $1.24 billion in Q4 2020.

Despite the Omicron variant’s effects on travel at the end of the fourth quarter, Booking Holdings Inc. said that its business still did better than expected. On an earnings call, David Goulden, the company’s Chief Financial Officer, said that he is encouraged by booking trends in the first quarter of 2022 so far and that nights booked in the first half of February were roughly in line with 2019 levels. Goulden said he expected 2022 full-year bookings to exceed 2021 levels.

New Travel Insurance Products

With Covid leading to high cancellation rates, Airbnb and Kayak have developed insurance products to provide a better service to their guests and, as a result, increase demand.

Airbnb is launching a travel insurance product and Covid support program to enable guests to navigate the unexpected impacts of the recent surge in Covid-19 cases worldwide.

Meanwhile, Kayak has now integrated two optional travel protection services into its digital platform, KAYAK Flex, and KAYAK Comprehensive.

Recovery

Optimism is in the air among United Airlines, British Airways, and other airline executives, logging accelerated business travel recovery.

2022 business travelers are anxious to travel again but still have concerns about possible Covid-exposure. Either way, 75% of travel management companies expect business travel volume to increase this year.

Travelers from the U.K., the Netherlands, Germany, and Poland plan to up their spending on trips by at least 39% in 2022 compared to 2019. Meanwhile, 80% of survey respondents say they plan to travel at least once in 2022.

Some other noteworthy consumer behavior trends for 2022 include:

1. Booking lead times have decreased dramatically: 60% of reservations are booked within one week of arrival.

2. Despite nerves, there is a growing desire to travel, with 75%+ of travelers hoping to take a trip in 2022.

3. There are likely to be less frequent but more extended stays (referred to as “workations”).

4. Cost-conscious travelers have become eco-conscious, with 66% of travelers seeing sustainable travel as a priority and more and more corporations requesting sustainable services when sending employees on business trips.

5. In-person events are returning, though on a smaller scale than pre-Covid times.

Safety, hygiene, and flexibility stay chief among traveler priorities; 31% of travelers want clearer health and safety protocols, 19% would be willing to pay more for the cleaning, and 30% are seeking more flexibility on changes to bookings. European travelers, meanwhile, also say they want touchless solutions.

Acquisitions, IPOs, and Investments

Venture Investment Trends

Venture Capital (VC) funding for startups in the travel industry strongly rebounded in 2021. Travel startups raised $8.6 billion in 2021, up 73% from 2020, and now nearly fully recovered at 90% of 2019 levels.

Regional Trends:

- The Asian Pacific market (APAC) rebounded strongly, becoming the largest region for travel VC funding with ~$3.5 billion raised in 2021, mainly bolstered by South Korea and Malaysia.

- Europe also saw some recovery in travel funding, with Germany, the UK, and Spain as the leading players.

The US and Canada continued to grow travel funding at 10% this year. In fact, the US was the largest market for VC globally, with $2.4 billion invested in 2021.

Operto Expansion

Operto Guest Technologies (and Guesty Marketplace Partner) will use a Series A funding round raised this month of $12 million to embark on an expansion program on multiple fronts.

Increased Hopper Activity

In February, Hopper executed a $35 million secondary sale of its shares at a $5 billion valuation and is funneling all profits back into marketing spending to accelerate growth. Hopper has also expanded into vacation rentals and has some two million homes on its books through partnerships.

In what would be an audacious move, Hopper also announced plans to offer a cancel-for-any-reason feature within the next few months.

Moreover, Hopper has made its third acquisition of the year, purchasing airline-merchandising and customer care platform, Smoos. Smooss provides solutions for increasing ancillary revenue and streamlining flight disruption recovery. The entire Smooss team will join Hopper, too.

Wander Expansion

Nine months after its founding, Austin, Texas-based Wander raised a $20 million Series A round this month led by QED Investors, bringing its total funding to $27 million. “We’re scaling rapidly to meet the demand of our more than 30,000 community members, with dozens more properties coming soon. We’re already seeing our vision for the future take shape”, a Wonder representative remarked.