As 2024 draws to a close, the short-term rental (STR) industry finds itself at a crossroads, shaped by the lingering effects of a global pandemic, economic uncertainties, and rapidly advancing technology. Our latest report offers a comprehensive look at what’s shaping the STR landscape, combining fresh survey data with actionable strategies to help operators navigate these shifts.

Sneak peek: What’s inside our full report?

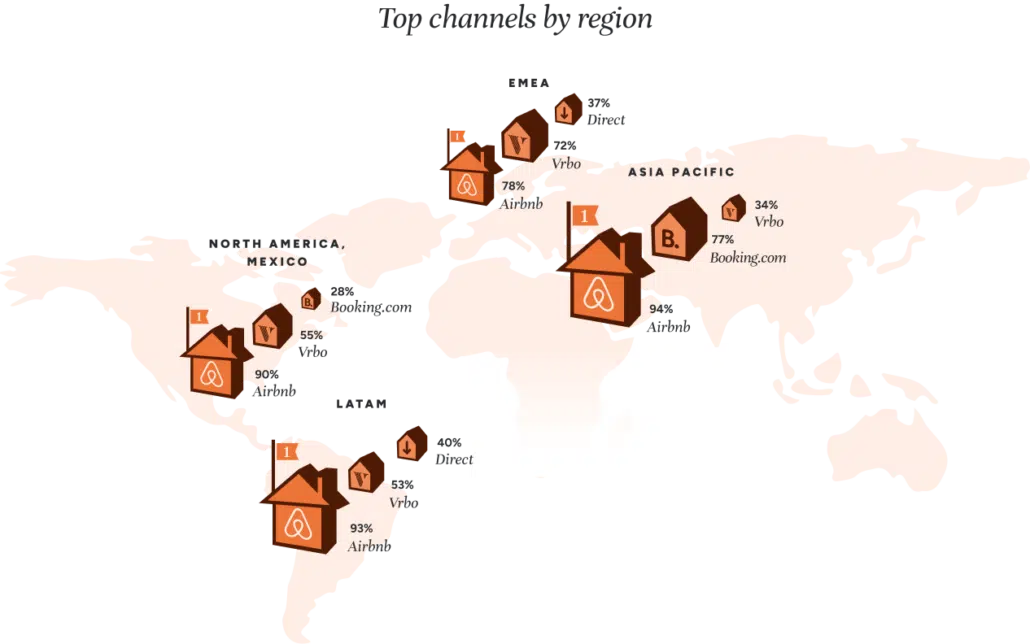

- Analysis of regional market trends across North America, EMEA, LATAM, and Asia Pacific

- Exclusive survey data from STR professionals of all sizes, revealing their challenges, strategies, and outlook

- An in-depth look at emerging technologies reshaping the industry

- Actionable strategies for differentiation, multi-channel distribution, enhancing guest experiences, and leveraging emerging technology

Key insights at a glance

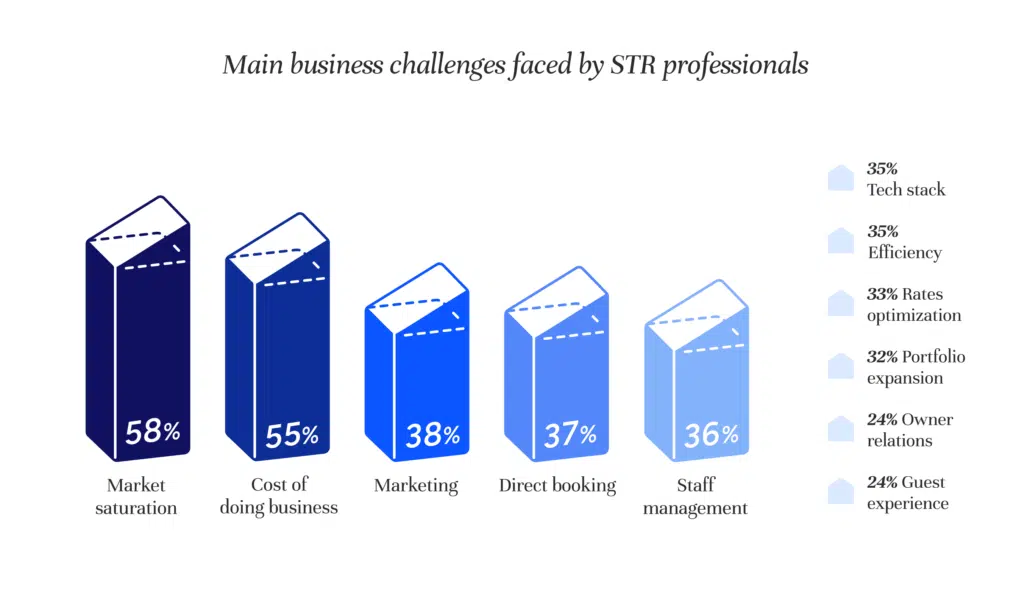

1. Standing out in a crowded market

In our survey, 58% of STR operators identified market saturation as a key challenge. Smaller operators in particular are feeling the squeeze from increased competition. The key to standing out? Our survey respondents highlighted pricing, amenities, and services as the top competitive edges, followed by design and unique offerings. This includes providing better and more distinctive amenities, and implementing impeccable check-in/out processes. Additionally, prompt and accurate communication emerged as a crucial factor in differentiation.

2. Meeting higher guest expectations

Our survey reveals that 79% of respondents have witnessed a change in guest expectations, with 60% noting higher quality service requests. To meet these shifting demands, STR operators can focus on several key areas, including implementing eco-friendly practices (75% of global travelers express a desire to travel more sustainably), offering loyalty incentives, and utilizing data to understand guest preferences and tailor their experiences.

3. Maximizing visibility across platforms

Diversifying your listing across multiple platforms is crucial. While Airbnb remains dominant, with 90% of respondents considering it a top channel for generating bookings, other platforms are gaining ground. Over 75% of operators also utilize Booking.com, and more than 80% list on Vrbo. Hosts utilizing a balanced distribution strategy, including direct booking websites, are finding more success and reducing reliance on third-party platforms.

4. Balancing tech and human touch

Over half of STR professionals are using AI to streamline operations, with many reporting significant time savings and enhanced efficiency. AI tools can assist with everything from dynamic pricing to automated guest communications. In fact, properties using AI-driven dynamic pricing report up to a 40% revenue increase. However, the challenge lies in striking the right balance between automation and maintaining the personal touch that defines exceptional hospitality.

A positive outlook for 2025

While challenges persist, 44% of operators foresee market growth in 2025, with only 15% anticipating a downturn. Success will rely on flexibility and innovation, particularly in adapting guest expectations and market dynamics.

To thrive in this evolving landscape, STR professionals should focus on implementing agile pricing strategies, embracing multi-channel distribution, investing in targeted marketing efforts, elevating guest experiences, and leveraging AI and PropTech solutions to enhance operational efficiency without sacrificing the human touch.

Download the full 2024 STR industry report to uncover in-depth analysis, data, and actionable strategies to help your business succeed in this ever-changing market.