A How-to: Buying Investment Property With Less Pain and Lasting Business

When it comes to buying investment property abroad, getting started means getting busy with lots of important questions – and this article is here to guide you through them.

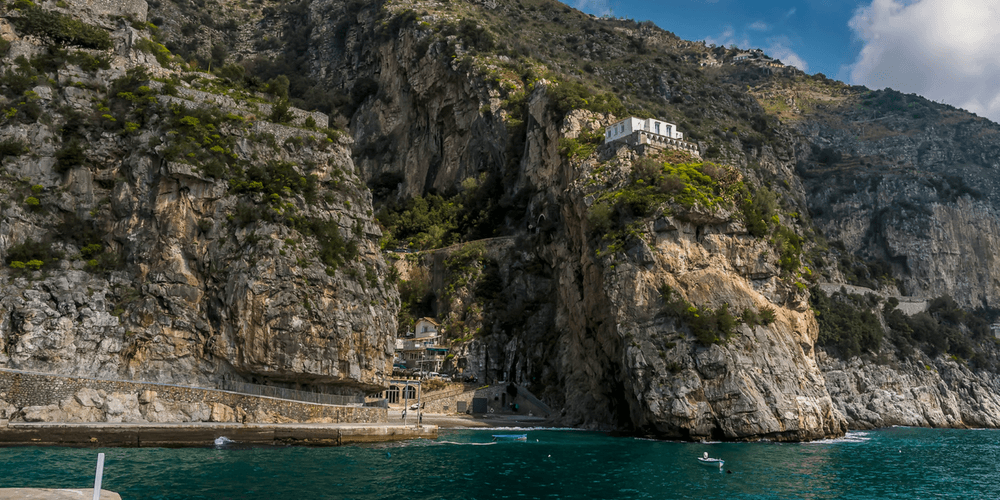

There are always overseas property investment “hotspots,” but understanding the potential of the property and place must be balanced with knowing what you can bring to the table. Once you get down to the details, what you really need is a good match – and a plan.

Before diving in, it should be clear to prospective buyers that as a profitable venture, foreign property investment is a long-term business plan. And aside from keeping up with tourism trends to be sure your property will serve its due purpose, there are a few fundamental factors that every plan needs in order to succeed.

The Property Investment Paradigm

The essentials to start with are: your financial goals, how much time you can dedicate, and the purpose of your investment. How much are you willing to invest in your new property, and how much return-on-investment (ROI) do you expect to receive within a certain period of time? How much time will you personally have to take care of your new property? How do you want the outcome of your investment to look, and how is your plan going to achieve this goal?

Once these foundations have been established, it’s time to get the real research started. Here’s everything else you should have in mind before going ahead with your investment abroad.

All That Legal Jazz

- It’s only natural that before you start looking, you should check on where you’re allowed to buy foreign property in the first place. Countries like Portugal are working to make the process as easy as possible, while countries like Singapore have made it notoriously difficult. Start your research with this comprehensive list of foreign ownership restrictions.

- Know Your Taxes:

Yes, they seem daunting…but everything is easier to find once you know what you’re looking for. These are the important taxes that may be relevant to your foreign property investment:

-

- Foreign income tax: countries can tax foreign income on resident citizens, non-resident citizens, and resident foreigners. This means that you should check with both your country of citizenship and your country of residency on their foreign income tax policies.

-

- Property tax: countries can collect property tax on foreign financial assets including property – sometimes only for citizens, but sometimes also for residents. Check to see if your countries of citizenship and property ownership require you to declare foreign or local real estate as a taxable asset. Countries with minimal property tax can be a huge benefit to your international property investment, and this list of countries without annual property tax can help you narrow down the countries you want to begin your search within.

-

- Double taxation treaty: some countries have entered into specific tax treaties called “double tax agreements” which prevent you from being taxed for the same assets in both countries which have entered into the agreement. If no agreed-upon treaty exists, you are subject to the respective tax legislation of each country.

-

- Stamp duty: this is a tax paid for the stampage of documents which makes them legally binding. Today, stamp duty for property is still collected in some places, although the physical stamp is rarely mandatory.

-

- Foreign buyer tax: this is an additional tax imposed upon individuals pursuing foreign property investments by some countries to earn extra revenue…because why not?

- Vacancy (or Empty Homes) tax: designed to increase the amount of available homes on the market, this taxes homes which aren’t being occupied for more than a set period of time.

And as an honorable mention: the ‘off-the-record’ tax. Mislabeled as a tax, this actually just refers to the additional cost of paying a local businessperson to ensure that others will respect your rights to a property – a highly recommended practice in the real estate industry.

3. Did that list make you a little terrified of all these taxes? Don’t worry! We have just the resource to start generating quick answers to your even more quickly accumulating questions: this sanctuary of worldwide tax summaries.

4. If you plan to take out a mortgage, you’ll have to check with your bank to see if they offer them for international real estate. Other factors can also affect this, like the country and your bank account itself.

5. Property deeds should be confirmed before purchase; make sure the seller has possession of the property deeds before buying from them, otherwise you will be the one who pays the price for a non-legal deal.

6. Analyze a property’s liquidity: how much rental traffic can be expected from it, and how much time it should take to re-sell. High tourism levels and heavy buyer competition offer more liquidity, whereas limited tourism and weak competition render a property illiquid.

To summarize: if a property isn’t competitive and the prospects for competitive turnaround are in the hands of the local economy and outside of your influence, it’s a bad investment.

Tips Beyond The Technical

The economic stability of the area should be a major deciding factor for an investment. Foreign residents and investors are often the first ones to have their pockets emptied during a period of economic instability. That’s why it’s important to either get to know the legal system, or ensure that you are well-represented. Take the 10-year minimum approach; a decade of relative stability with few fluctuations is more likely to bring your business plan success.

Hiring an experienced property lawyer isn’t a requirement, but it can prevent serious complications by finding anything problematic in a contract or the respective taxation policies before you sign anything. If you’re considering using a law firm outside of the country you’re buying property in, make sure that they are licensed to practice in the country where you will make your purchase, and fluent in both languages.

If you’re considering investment alternatives to directly buying foreign property, you also may want to consider Real Estate Investment Trusts, called REIT’s. These are organized to allow more generic investments in a company which acquires a variety of properties and will have specific policies for the processes and percentages of receiving ROI.

NOW You’re Prepared!

No matter what avenue you take on this international property investment journey, one of the most crucial pieces of advice you should listen to is: network.

Reach out to other experienced investors in the areas you’re considering getting involved in. By connecting with them, a novice property investor stands to learn a lot about what’s written between the lines of legislation and business.

If buying investment property is sounding like a lot of work right about now, well, that’s because it is. Nevertheless – it’s being called one of the best investments of our time for good reason, and there’s no shortage of available information on the market to slow you down. Start with an easy guide to some great upcoming places for investment.

Once you’re ready for your business to take off, be sure you’re doing everything you can to make it soar by using the right property management software.